Battery Energy Storage System

ENQUIRE NOWThe National Electricity Market (NEM) Landscape is Changing

As the world shifts towards sustainable energy sources, solar energy has emerged as a key player in mitigating the effects of climate change. However, with the rise in solar energy usage, the stability and reliability of the electrical grid encounter specific challenges. The intermittent and variable nature of solar power can cause fluctuations in grid frequency and voltage.

Business can Now Access the Wholesale Electricity Market

To maintain grid stability and reliability, it is essential to develop advanced strategies and technologies to manage the impact of solar energy on the grid. One solution is energy storage systems, which can capture surplus solar energy and supply it to the grid during periods of low solar output. This helps to stabilize the grid’s frequency and voltage. In return, businesses are financially incentivized which often result in fast return

Transformer Capacity vs Availability

Accessing the wholesale market Is not given to everyone as your transformer capacity dictates whether you will be granted grid access or not. This will be determined by your DNSP during the application process. Like solar, DNSP assess the application based on your transformer capacity and other already connected solar and battery storage systems – these are often first come first serve scenarios.

Boost Your Earnings with BESS

Revenue Streams In Australia

Get in touch with our BESS experts

3 Revenue Streams for BESS in Australia

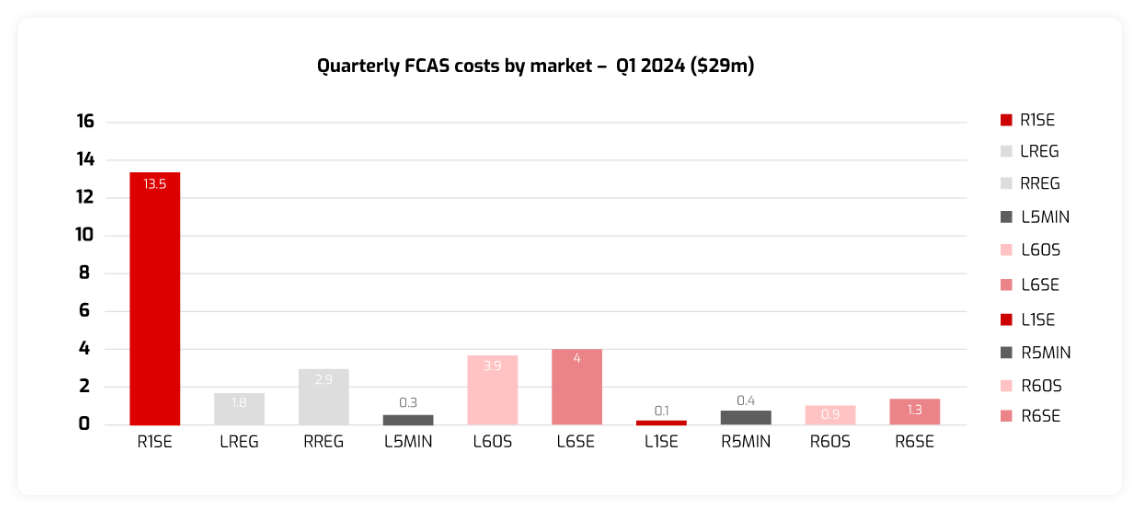

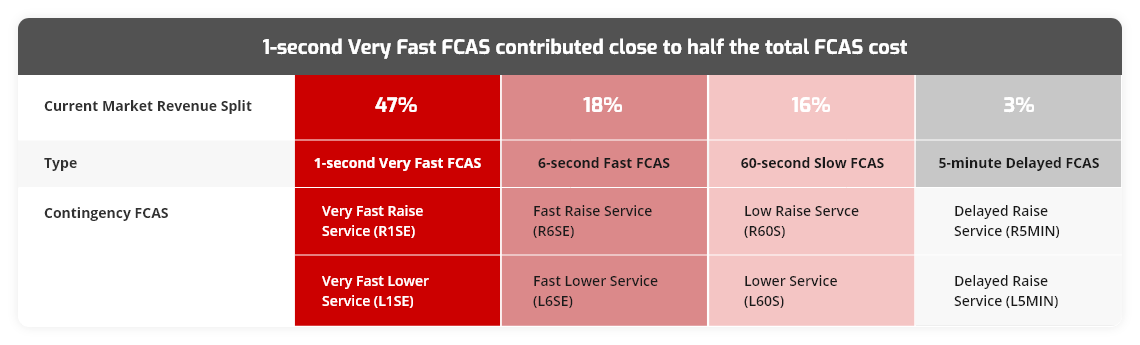

Battery Storage Dominates FCAS Market

Battery storage is now confirmed to be the leading dominant in the provision of key services to the grid. From the latest Quarterly Energy Dynamics report from the Australian Energy Market Operator, it reveals that batteries took a 52 percent share in the frequency and ancillary services (FCAS) market in the 2nd QTR of 2024.

FCAS Market Services: Contingency and Regulation

Contingency FCAS Market

Regulation FCAS Market

Get Started with Battery Storage Now!

Energy Arbitrage Focuses on Price Differences to Maximize Savings or Profit

Battery energy storage systems (BESS) generate revenue effectively by charging when electricity prices are low or negative and selling the stored energy back to the grid when wholesale prices are high.

According to Australian Energy Market Operator (AEMO), the National Electricity Market (NEM) has seen a 97% year-on-year increase in energy arbitrage revenues for BESS.

The grid price in the left graph is trending below $100 per MWh, turning negative around midday when solar power (PV) is supplying the grid. In the evening, prices surge due to high demand. Batteries can take advantage of negative pricing to charge and then discharge during peak times, generating significant revenue.

Peak Demand Reduction = Reduce Peak Demand Charges

Company A

Company B

Maximizing Value with Aggregators

- Lowest project set up cost

- Lowest ongoing market participant costs

- Highest % of revenue shared to our clients

Product Overview

Our flexible energy storage solutions are tailored to meet the specific needs and preferences of our customers. They are managed using advanced optimization software powered by machine learning and artificial intelligence, ensuring superior battery performance, maximum savings, and additional revenue opportunities.

Capability Statement

Download our Capability Statement to read more on our company, our people, our capabilities and our projects.

DOWNLOAD NOW

Check Our Latest Videos

Explore our recent projects and Youtube channel to see how we carefully execute our installations to meet the unique business requirements of our customers. From large-scale solar roof installations to LED lighting upgrades and solar battery storage systems, there’s no project too big or small for our team

Contact Us

Get In Touch, We Love Talking Solar!

Fill out the form below to contact us!

Industry Partnerships

Get Quote

Get Quote Call Now

Call Now