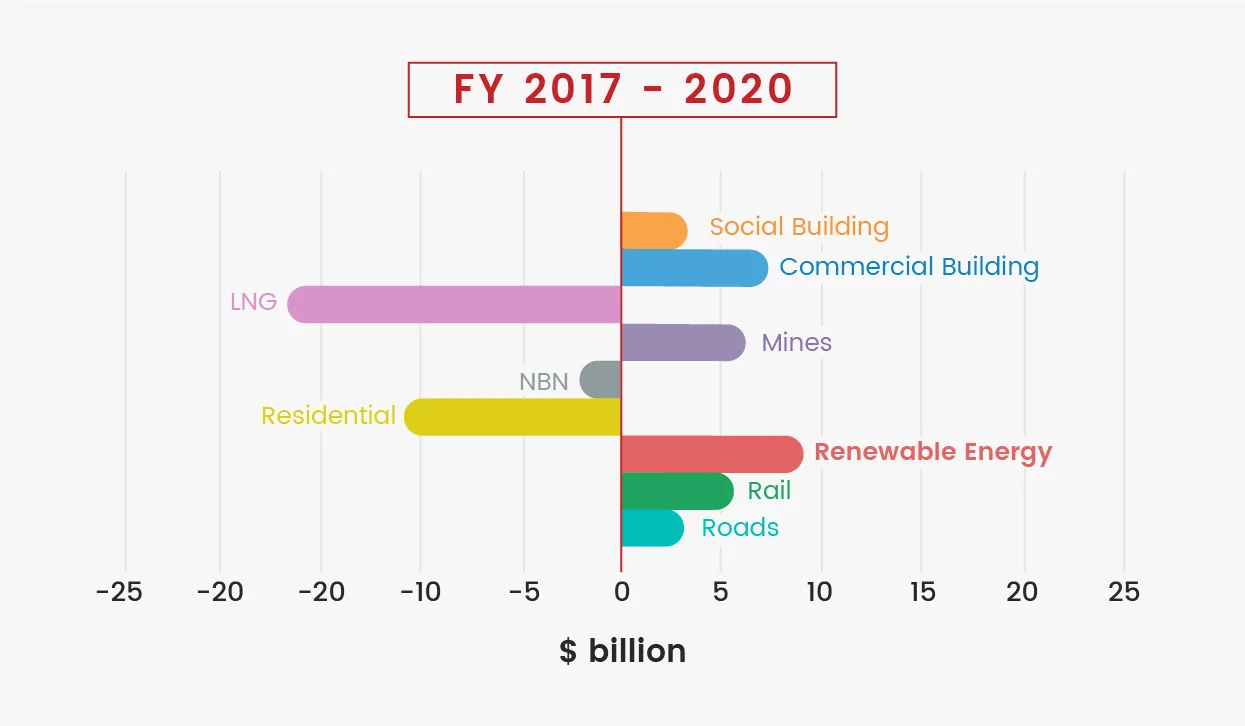

Despite Australia’s weakest GDP growth since 1992, renewable energy investment has increased by $9 billion in three years! In a New Daily article by Michael Pascoe, the data is somewhat surprising. It shows that renewable energy growth has outstripped that of a commercial building, roading, rail and mining.

The fortunate conclusion, supported by Macromonitor economist Natalie Keogh is “The extraordinary boom in the renewables sector is currently the largest contributor to overall growth in construction in Australia.”

In a period where telecommunication (NBN), utilities infrastructure, including water and wastewater are in decline – renewable energy investments are being praised as staving off an economic downturn.

Despite being well on track to meet 2020 targets, more & more renewable projects are being committed. The implication is their commercial viability, rather than government incentives, are what is driving this growth snowball. Australians can, therefore, be cautiously optimistic that this trend will continue.

“Renewables” is an umbrella term which refers to solar, wind and storage (batteries). Industry research company Macromonitor suggests that the solar component has been the most significant in keeping the Australian economy on track. This is set to change, however: Energy storage is set for a boom in the middle of next decade, as solar and wind reach oversupply.

Despite being subject to the usual cyclical nature of economies, renewable investment is expected to be “permanently higher” than in the past. With much of our other utilities expected to suffer for the next 20 years, Australia’s economy (not to mention the environment) owes a lot to renewable electricity generation.

Get Quote

Get Quote Call Now

Call Now